Why Lease a Car: The Benefits of Car Leasing

When it comes to buying a car, there are two options: leasing or buying. While buying a car is the traditional choice, leasing has become increasingly popular in recent years due to its many benefits. In this article, we will explain the benefits of leasing a car, the tax advantages of car leasing, the differences between leasing and buying, car leasing options, how to lease a car, and common car leasing terms and definitions.

Benefits of Leasing a Car

One of the main benefits of leasing a car is lower monthly payments compared to buying a car. When you lease a car, you are essentially renting it for a certain period of time, typically two to three years. Because you are only paying for the car’s depreciation during that time, your monthly payments are lower than if you were financing the entire cost of the car.

If you’re wondering whether car leasing is a good idea, check out this article on cars311.com link.

Leasing also gives you access to newer cars that you might not be able to afford if you were buying. Since you are only leasing the car for a few years, you can trade it in for a new one when the lease is up. This means you can always have the latest technology and features without having to worry about selling or trading in your old car.

Another benefit of leasing a car is that it often comes with less maintenance and repair costs. Most leases come with a warranty that covers any major repairs, and you typically don’t have to worry about routine maintenance like oil changes or tire rotations.

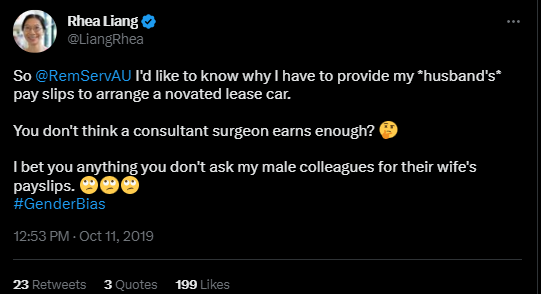

On Twitter, @LiangRhea mentioned an additional benefit of car leasing: flexibility. Leasing offers the option for early termination or lease transfers if your life circumstances change during the lease term. This allows you to try out different cars without committing to long-term ownership. With lower monthly payments, access to newer cars, and tax advantages, leasing can be a smart choice for many drivers link.

Tax Advantages of Leasing a Car

Leasing a car can also offer tax advantages, especially if you use the car for business purposes. For example, you can deduct the lease payments as a business expense, as well as other costs associated with the car like gas, insurance, and maintenance.

In addition, you can also save on sales tax when you lease a car. Instead of paying sales tax on the entire cost of the car, you only pay sales tax on the lease payments. This can result in significant savings, especially if you live in a state with high sales tax rates.

Leasing vs Buying a Car

While leasing has many benefits, it’s important to weigh the pros and cons of leasing versus buying a car. One of the main differences between leasing and buying is that when you lease a car, you don’t own it. This means you have to return the car at the end of the lease and can’t use it as a trade-in when you’re ready to buy a new car.

Pros of leasing include lower monthly payments, access to newer cars, and less maintenance and repair costs. Cons of leasing include restrictions on mileage and modifications, as well as the fact that you don’t own the car.

Pros of buying include ownership of the car, no mileage restrictions, and the ability to modify the car as you see fit. Cons of buying include higher monthly payments, higher upfront costs, and potentially higher maintenance and repair costs over time.

Car Leasing Options

When it comes to leasing a car, there are several options to choose from. The two main types of leases are personal leases and business leases. Personal leases are for individuals who want to lease a car for personal use, while business leases are for companies that want to lease cars for business purposes.

If you’re considering leasing a car, it’s important to understand how to negotiate a lease to get the best possible deal link.

There are also different types of leasing options within each category, including closed-end leases and open-end leases. Closed-end leases are the most common type of lease and allow you to return the car at the end of the lease without any further financial obligation. Open-end leases are less common and require you to pay the difference between the residual value of the car and its actual value at the end of the lease.

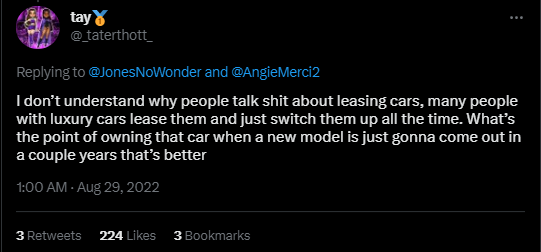

However, there are some helpful tips and insights to be found on Twitter, such as @taterthott’s thread on the benefits of car leasing link.

How to Lease a Car

Leasing a car is a great option for those who want to drive a new car every few years without committing to the long-term ownership of a vehicle. Here are the steps to take when leasing a car:

- Steps Involved in Leasing a Car

- Research and Choose a Car: Start by researching the type of car you want to lease, including its make, model, and trim level. Consider your budget, lifestyle, and driving needs when making your choice.

- Find a Dealership: Once you have decided on the car you want to lease, find a reputable dealership that offers leasing options. Look for reviews and ratings online to ensure you are working with a reliable dealer.

- Negotiate Lease Terms: Negotiate the lease terms, including the monthly payment, mileage limit, and lease term. Make sure you understand all the terms of the lease agreement before signing it.

- Sign the Lease Agreement: Once you have agreed to the lease terms, sign the lease agreement. Make sure to read the agreement carefully and ask any questions you may have before signing.

- Make the Initial Payment: You will need to make an initial payment, which includes the first month’s payment, a security deposit, and other fees. Be sure to ask the dealer for a breakdown of the costs.

- Drive Away in Your New Car: After completing all the necessary paperwork and making the initial payment, you are ready to drive away in your new leased car!

- Common Car Leasing Terms and Definitions

Here are some common terms you may encounter when leasing a car:

- Capitalized cost: The price of the car, including any fees, that is used to calculate the lease payment.

- Residual value: The predicted value of the car at the end of the lease term.

- Money factor: The interest rate on the lease, expressed as a decimal.

- Mileage limit: The maximum number of miles you are allowed to drive during the lease term.

- Excess mileage fee: The fee you will be charged for every mile over the mileage limit.

- Disposition fee: The fee you will be charged at the end of the lease term to cover the cost of preparing the car for sale.

FAQ

Leasing allows you to drive a new car every few years without committing to long-term ownership, while buying a car means you own it and can keep it as long as you want.

A typical car lease is around three years, although lease terms can vary.

Yes, you can negotiate the lease terms, including the monthly payment, mileage limit, and lease term.

Yes, you can usually buy the car at the end of the lease term, although the price may be higher than the residual value.

If you go over the mileage limit, you will be charged an excess mileage fee.

Most lease agreements prohibit modifications to the car, although some minor modifications may be allowed with prior approval from the leasing company.